Schedule C Form 1040 Fillable Form & PDF Sample FormSwift 2022-2026

Understanding the Schedule C Form 1040 Fillable Form

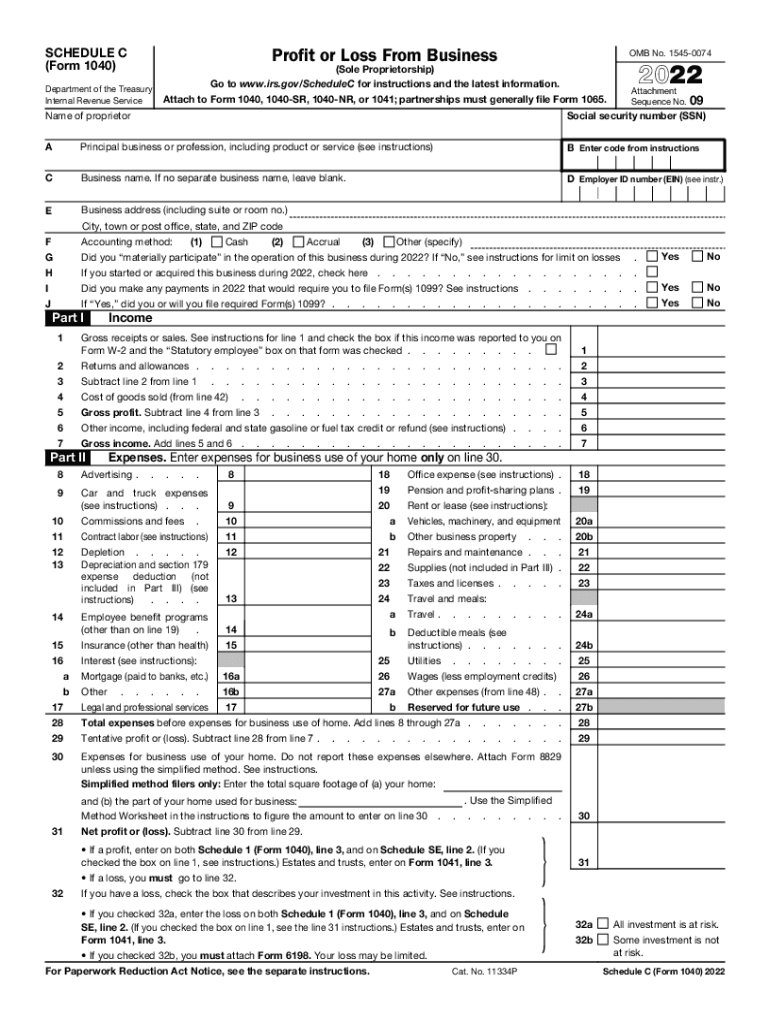

The Schedule C form, officially known as the "Profit or Loss from Business" form, is essential for self-employed individuals in the United States. This form is used to report income and expenses related to a business operated as a sole proprietorship. The fillable version allows users to complete the form digitally, making it easier to enter information accurately and efficiently. The Schedule C form is part of the IRS Form 1040 series, which is used for individual income tax returns.

Steps to Complete the Schedule C Form 1040 Fillable Form

Filling out the Schedule C form involves several key steps:

- Gather your financial records: Collect all necessary documents, including income statements, expense receipts, and any other relevant financial data.

- Enter your business information: Fill in your name, business name, and address. Specify the type of business you operate.

- Report your income: Include all sources of income from your business activities. This may include sales, services, and any other revenue streams.

- List your expenses: Document all business-related expenses, such as advertising, utilities, and supplies. Ensure you categorize expenses accurately.

- Calculate your net profit or loss: Subtract total expenses from total income to determine your net profit or loss for the year.

- Review and finalize: Double-check all entries for accuracy before submitting the form. Ensure that all required signatures are included.

Legal Use of the Schedule C Form 1040 Fillable Form

The Schedule C form is legally binding when filled out correctly and submitted to the IRS. It is crucial to ensure that all information is accurate and truthful, as any discrepancies can lead to penalties or audits. The form must be filed annually, and it plays a significant role in determining your tax liability as a self-employed individual. Compliance with IRS guidelines is essential to avoid any legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule C form align with the general tax return deadlines. Typically, the due date for submitting your individual income tax return, including Schedule C, is April 15 of the following year. If you require additional time, you may file for an extension, which generally extends the deadline by six months. However, any taxes owed must still be paid by the original due date to avoid penalties.

IRS Guidelines for Schedule C Form Submission

The IRS provides specific guidelines for completing and submitting the Schedule C form. It is important to follow these guidelines to ensure compliance and accuracy. The form can be submitted electronically or via mail. If filing electronically, ensure that you use IRS-approved software that supports the Schedule C form. If mailing, send the completed form to the appropriate IRS address based on your location.

Required Documents for Schedule C Form

When completing the Schedule C form, certain documents are necessary to support your reported income and expenses. These documents may include:

- Income statements from your business.

- Receipts for business expenses.

- Bank statements related to your business accounts.

- Previous tax returns, if applicable.

Having these documents organized will facilitate a smoother filing process and ensure that you have all necessary information at hand.

Quick guide on how to complete schedule c form 1040free fillable form ampamp pdf sample formswift

Effortlessly Complete Schedule C Form 1040 Fillable Form & PDF Sample FormSwift on Any Device

Digital document management has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without any hassles. Manage Schedule C Form 1040 Fillable Form & PDF Sample FormSwift on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes immediately.

How to Modify and Electronically Sign Schedule C Form 1040 Fillable Form & PDF Sample FormSwift with Ease

- Obtain Schedule C Form 1040 Fillable Form & PDF Sample FormSwift and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would prefer to send your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, frustrating form navigation, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Schedule C Form 1040 Fillable Form & PDF Sample FormSwift and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule c form 1040free fillable form ampamp pdf sample formswift

Create this form in 5 minutes!

People also ask

-

What is the schedule c fillable form 2020?

The schedule c fillable form 2020 is a tax form used by sole proprietors to report income and expenses. It provides an easy way to input financial information directly for your tax filings, helping to streamline the process. Using the schedule c fillable form 2020 can signNowly simplify your annual tax preparation.

-

How can airSlate SignNow help with the schedule c fillable form 2020?

airSlate SignNow allows you to easily create, edit, and eSign the schedule c fillable form 2020. Our platform streamlines the process, making it hassle-free to fill out and submit your form. With our user-friendly interface, managing your tax documents becomes quick and efficient.

-

Is there a cost to use the schedule c fillable form 2020 on airSlate SignNow?

Using airSlate SignNow for the schedule c fillable form 2020 is cost-effective, with various pricing plans to meet your business needs. We offer competitive pricing that allows you to maximize your savings while ensuring your document signing needs are met. Check our pricing page for detailed options.

-

What features does airSlate SignNow provide for the schedule c fillable form 2020?

AirSlate SignNow offers a range of features for the schedule c fillable form 2020, including real-time collaboration, secure eSigning, and automated workflows. These features ensure that you can complete and send your forms efficiently while maintaining compliance. Additionally, our platform allows for easy storage and retrieval of completed forms.

-

Can I integrate airSlate SignNow with other software when dealing with the schedule c fillable form 2020?

Yes, airSlate SignNow seamlessly integrates with various accounting and business software, enhancing your experience with the schedule c fillable form 2020. This means you can easily import data from your accounting tools and manage your tax documents without switching platforms. Enjoy a unified workflow designed to save you time.

-

What are the benefits of using airSlate SignNow for the schedule c fillable form 2020?

Using airSlate SignNow for the schedule c fillable form 2020 offers numerous benefits, such as time savings, increased efficiency, and enhanced security. Our platform ensures your documents are protected while being easy to access and manage. Enjoy the flexibility of signing anywhere and from any device.

-

Is it easy to fill out the schedule c fillable form 2020 on airSlate SignNow?

Absolutely! AirSlate SignNow is designed with user experience in mind, making it easy to fill out the schedule c fillable form 2020. With its intuitive interface and guided prompts, even those unfamiliar with tax forms will find the process straightforward and user-friendly.

Get more for Schedule C Form 1040 Fillable Form & PDF Sample FormSwift

- Ohio disclaimer form

- Mechanics lien ohio form

- Quitclaim deed by two individuals to llc ohio form

- Ohio two llc form

- Limited warranty deed from two individuals to llc ohio form

- Deed husband wife 497322211 form

- General warranty deed eight individuals to ten individuals ohio form

- Quitclaim deed from husband and wife to two individuals ohio form

Find out other Schedule C Form 1040 Fillable Form & PDF Sample FormSwift

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template